Life Insurance Agent Near Me

Life Insurance Agent Near Me

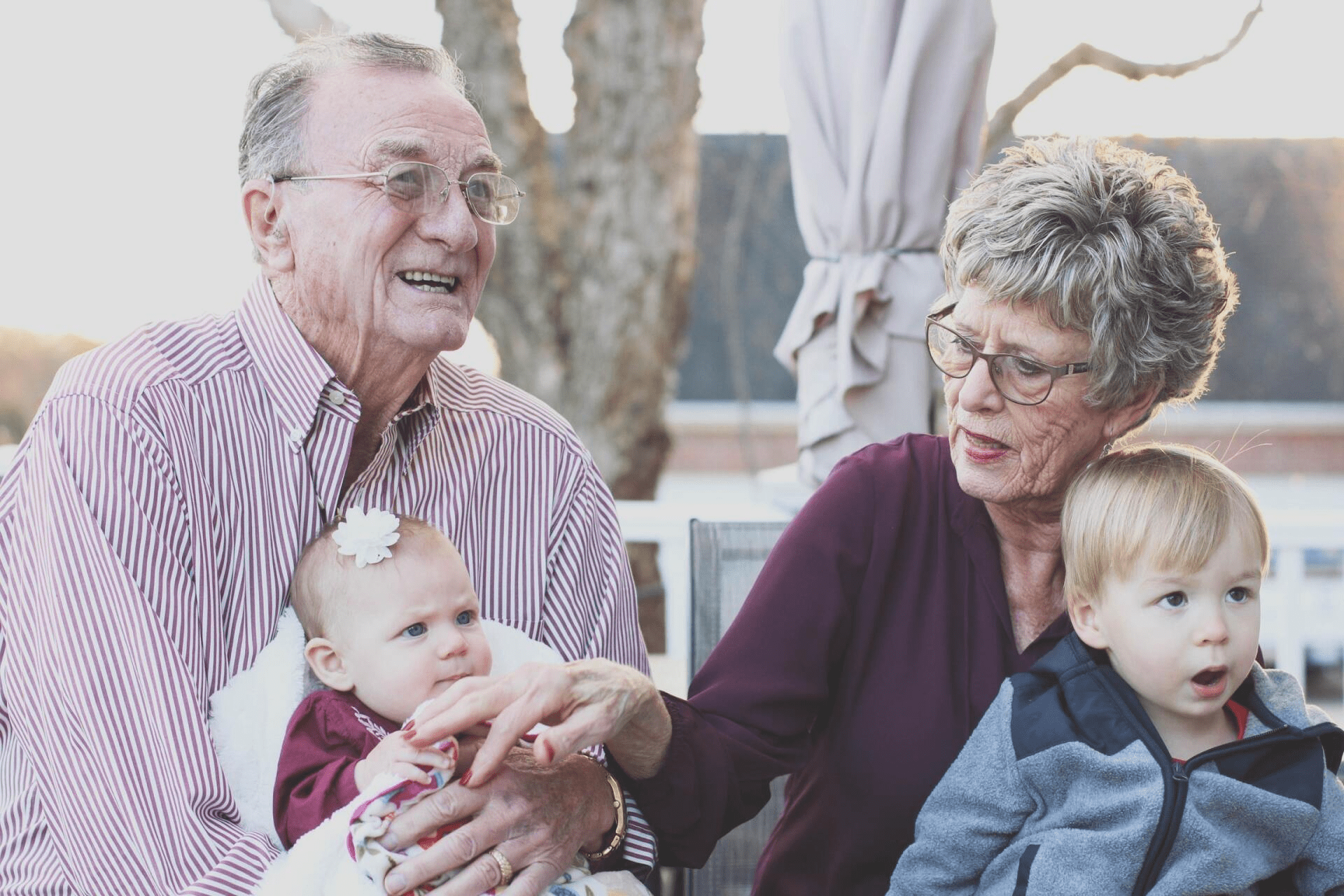

Finding a life insurance agent near you can be a valuable step in securing the right coverage for your needs. Life insurance agents are licensed professionals who can help you navigate the complexities of life insurance, understand your options, and find a policy that aligns with your financial goals.

To find a life insurance agent near you, consider using online directories, asking for referrals from friends or family, or contacting your local Chamber of Commerce for recommendations. Once you find a potential agent, schedule a consultation to discuss your insurance needs and explore the available coverage options. Working with a knowledgeable and trustworthy life insurance agent can provide you with peace of mind, knowing that you have secured the right protection for your loved ones' financial future.

What We Offer

Whole Life Insurance

Whole life insurance policies never expire and grow at a guaranteed rate. In addition to the death benefit that is paid out, there is also a savings payout which can accumulate value over time. The savings component can also be invested or accessed by the policyholder during their life.

Life Insurance FAQs

Got a question? We’re here to help.

Andrew F. McClintock Associates, Inc. has been helping people about life insurance agent near me for years! Our expertise extends to life insurance agent near me . But we’re here to walk you through the process so you can know exactly what you’re getting and at exactly what price regarding life insurance agent near me . Our team will make sure you’re covered so that should the unthinkable happen, you don’t have to worry about those you leave behind. If you’ve got any questions, please don’t hesitate to call. We’re happy to help you about life insurance agent near me options that are just right for you. We are your trusted partner in life insurance agent near me .

When you give us a call, you will be connected directly to one of our friendly independent agents, so you can expect immediate attention to your inquiry about life insurance agent near me

. Call us today at (513) 421-2522 or call our 24/7 message line at (800) 543-8501.